Bài liên quan

Developed by Gerald Appel in the late seventies, Moving Average Convergence-Divergence (MACD) is one of the simplest and most effective momentum indicators available. MACD turns two trend-following indicators, moving averages, into a momentum oscillator by subtracting the longer moving average from the shorter moving average. As a result, MACD offers the best of both worlds: trend following and momentum. MACD fluctuates above and below the zero line as the moving averages converge, cross and diverge. Traders can look for signal line crossovers, centerline crossovers and divergences to generate signals. Because MACD is unbounded, it is not particularly useful for identifying overbought and oversold levels.

Calculation

MACD: (12-day EMA - 26-day EMA)

Signal Line: 9-day EMA of MACD

MACD Histogram: MACD - Signal Line

Standard MACD is the 12-day Exponential Moving Average (EMA) less the 26-day EMA. Closing prices are used for these moving averages. A 9-day EMA of MACD is plotted with the indicator to act as a signal line and identify turns. The MACD-Histogram represents the difference between MACD and its 9-day EMA, the signal line. The histogram is positive when MACD is above its 9-day EMA and negative when MACD is below its 9-day EMA.

Interpretation

As its name implies, MACD is all about the convergence and divergence of the two moving averages. Convergence occurs when the moving averages move towards each other. Divergence occurs when the moving averages move away from each other. The shorter moving average (12-day) is faster and responsible for most MACD movement. The longer moving average (26-day) is slower and less reactive to price changes in the underlying security.

MACD oscillates above and below the zero line, which is also known as the centerline. These crossovers signal that the 12-day EMA has crossed the 26-day EMA. The direction, of course, depends on direction of the moving average cross. Positive MACD indicates that the 12-day EMA is above the 26-day EMA. Positive values increase as the shorter EMA diverges further from the longer EMA. This means upside momentum is increasing. Negative MACD indicates that the 12-day EMA is below the 26-day EMA. Negative values increase as the shorter EMA diverges further below the longer EMA. This means downside momentum is increasing.

In the example above, the yellow area shows MACD in negative territory as the 12-day EMA trades below the 26-day EMA. The initial cross occurred at the end of September (black arrow) and MACD moved further into negative territory as the 12-day EMA diverged further from the 26-day EMA. The orange area highlights a period of positive MACD, which is when the 12-day EMA was above the 26-day EMA. Notice that MACD remained below 1 during this period (red dotted line). This means the distance between the 12-day EMA and 26-day EMA was less than 1 point, which is not a big difference.

Signal Line Crossovers

Signal line crossovers are the most common MACD signals. The signal line is a 9-day EMA of MACD. As a moving average of the indicator, it trails MACD and makes it easier to spot turns in MACD. A bullish crossover occurs when MACD turns up and crosses above the signal line. A bearish crossover occurs when MACD turns down and crosses below the signal line. Crossovers can last a few days or a few weeks, it all depends on the strength of the move.

Due diligence is required before relying on these common signals. Signal line crossovers at positive or negative extremes should be viewed with caution. Even though MACD does not have upper and lower limits, chartists can estimate historical extremes with a simple visual assessment. It takes a strong move in the underlying security to push momentum to an extreme. Even though the move may continue, momentum is likely to slow and this will usually produce a signal line crossover at the extremities. Volatility in the underlying security can also increase the number of crossovers.

Chart 2 shows IBM with its 12-day EMA (green), 26-day EMA (red) and MACD (12,26,9) in the indicator window. There were eight signal line crossovers in six months: four up and four down. There were some good signals and some bad signals. The yellow area highlights a period when MACD surged above 2 to reach a positive extreme. There were two bearish signal line crossovers in April and May, but IBM continued trending higher. Even though upward momentum slowed after the surge, upward momentum was still stronger than downside momentum in April-May. The third bearish signal line crossover in May resulted in a good signal.

Centerline Crossovers

Centerline crossovers are the next most common MACD signals. A bullish centerline crossover occurs when MACD moves above the zero line to turn positive. This happens when the 12-day EMA of the underlying security moves above the 26-day EMA. A bearish centerline crossover occurs when MACD moves below the zero line to turn negative. This happens when the 12-day EMA moves below the 26-day EMA.

Centerline crossovers can last a few days or a few months. It all depends on the strength of the trend. MACD will remain positive as long as there is a sustained uptrend. MACD will remain negative when there is a sustained downtrend. Chart 3 shows Pulte Homes (PHM) with at least four centerline crosses in nine months. The resulting signals worked well because strong trends emerged with these centerline crossovers.

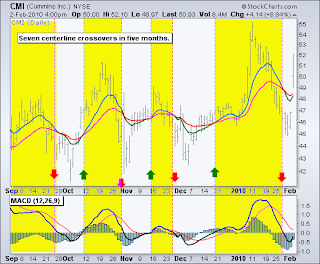

Chart 4 shows Cummins Inc (CMI) with seven centerline crossovers in five months. In contrast to Pulte Homes, these signals would have resulted in numerous whipsaws because strong trends did not materialize after the crossovers.

Chart 5 shows 3M (MMM) with a bullish centerline crossover in late March 2009 and a bearish centerline crossover in early February 2010. This signal lasted 10 months. In other words, the 12-day EMA was above the 26-day EMA for 10 months. This was one strong trend.

Divergences

Divergences form when MACD diverges from the price action of the underlying security. A bullish divergence forms when a security records a lower low and MACD forms a higher low. The lower low in the security affirms the current downtrend, but the higher low in MACD shows less downside momentum. Despite less downside momentum, downside momentum is still outpacing upside momentum as long as MACD remains in negative territory. Slowing downside momentum can sometimes foreshadows a trend reversal or a sizable rally.

Chart 6 shows Google (GOOG) with a bullish divergence in October-November 2008. First, notice that I am using closing prices to identify the divergence. The MACD moving averages are based on closing prices and we should consider closing prices in the security as well. Second, notice that there were clear reaction lows (troughs) as both Google and MACD bounced in October and late November. Third, notice that MACD formed a higher low as Google formed a lower low in November. MACD turned up with a bullish divergence with a signal line crossover in early December. Google confirmed a reversal with resistance breakout.

A bearish divergence forms when a security records a higher high and MACD forms a lower high. The higher high in the security is normal for an uptrend, but the lower high in MACD shows less upside momentum. Even though upside momentum may be less, upside momentum is still outpacing downside momentum as long as MACD is positive. Waning upward momentum can sometimes foreshadow a trend reversal or sizable decline.

Chart 7 shows Gamestop (GME) with a large bearish divergence from August to October. The stock forged a higher high above 28, but MACD fell short of its prior high and formed a lower high. The subsequent signal line crossover and support break in MACD were bearish. On the price chart, notice how broken support turned into resistance on the throwback bounce in November (red dotted line). This throwback provided a second chance to sell or sell short.

Divergences should be taken with caution. Bearish divergences are commonplace in a strong uptrend, while bullish divergences occur often in a strong downtrend. Yes, you read right. Uptrends often start with a strong advance that produces a surge in upside momentum (MACD). Even though the uptrend continues, it continues at a slower pace that causes MACD to decline from its highs. Upside momentum may not be as strong, but upside momentum is still outpacing downside momentum as long as MACD is above the zero line. The opposite occurs at the beginning of a strong downtrend.

Chart 8 shows the S&P 500 ETF (SPY) with four bearish divergences from August to November 2009. Despite less upside momentum, the ETF continued higher because the uptrend was strong. Notice how SPY continued its series of higher highs and higher lows. Remember, upside momentum is stronger than downside momentum as long as MACD is positive. MACD (momentum) may have been less positive (strong) as the advance extended, but it was still largely positive.

Conclusions

MACD is special because it brings together momentum and trend in one indicator. This unique blend of trend and momentum can be applied to daily, weekly or monthly charts. The standard setting for MACD is the difference between the 12 and 26-period EMAs. Chartists looking for more sensitivity may try a shorter short-term moving average and a longer long-term moving average. MACD(5,35,5) is more sensitive than MACD(12,26,9) and might be better suited for weekly charts. Chartists looking for less sensitivity may consider lengthening the moving averages. A less sensitive MACD will still oscillate above/below zero, but the centerline crossovers and signal line crossovers will be less frequent.

MACD is not particularly good for identifying overbought and oversold levels. Even though it is possible to identify levels that are historically overbought or oversold, MACD does not have any upper or lower limits to bind its movement. MACD can continue to overextend beyond historical extremes during sharp moves.

MACD calculates the absolute difference between two moving averages. This means MACD values are dependent on the price of the underlying security. MACD for a $20 stocks may range from -1.5 to 1.5, while MACD for a $100 may range from -10 to +10. It is not possible to compare MACD values for a group of securities with varying prices. An alternative is to use the Percentage Price Oscillator (PPO), which shows the percentage difference between two moving averages.

MACD and SharpCharts

MACD can be set as an indicator above, below or behind a security's price plot. Placing MACD behind the makes it easy to compare momentum movements with price movements. Once the indicator is chosen from the drop down list, the default parameter setting appears (12,26,9). These parameters can be adjusted to increase sensitivity or decrease sensitivity. The MACD-Histogram appears with the indicator or can be added a separate indicator. Setting the signal line to 1 (12,26,1) will remove the MACD histogram and the signal line. A separate signal line, without the histogram, can be added by choosing "advanced options/Exp Mov Avg". Click here for a live example of MACD.

Suggested Scans

MACD Bullish Signal Line Cross: This scan reveals stocks that are trading above their 200-day moving average and have a bullish signal line crossover in MACD. Also notice that MACD is required to be negative to insure this upturn occurs after a pullback. This scan is just meant as a starter for further refinement.

MACD Bearish Signal Line Cross: This scan reveals stocks that are trading below their 200-day moving average and have a bearish signal line crossover in MACD. Also notice that MACD is required to be positive to insure this downturn occurs after a bounce. This scan is just meant as a starter for further refinement.

Further Study

Book: Technical Analysis - Power Tools for Active Investors by Gerald Appel. This book offers a complete course in market forecasting from the creator of MACD. Short, intermediate and long term strategies are explained with many incorporating MACD.

Book: Understanding MACD by Gerald Appel and Edward Dobson. From the creator, this book offers a comprehensive guide to using and interpreting MACD.

From http://stockcharts.com/school/doku.php?id=chart_school:technical_indicators:moving_average_conve

0 nhận xét:

Đăng nhận xét